By Greg Dowell

•

December 30, 2024

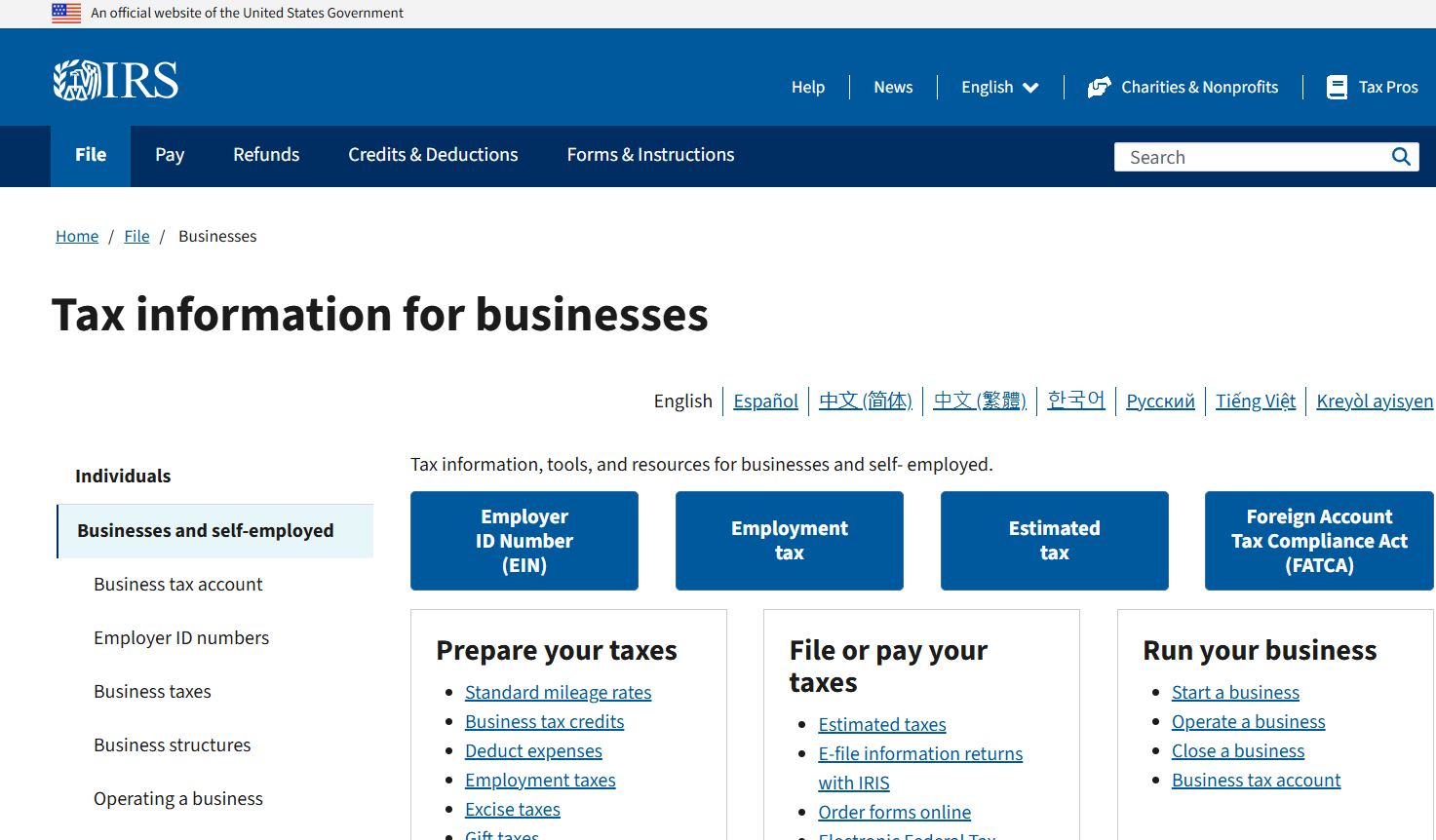

December 16, 2024 The following letter was prepared and distributed to clients and friends of Dowell Group, LLP. The letter discusses individual and business tax planning ideas that may be appropriate in certain situations. This does not represent tax advice, as every situation must be considered on its own merits. Dear Clients and Friends, As we near the end of another year, it can be worthwhile to take a few moments to consider if there are any additional actions that should be taken to improve your tax positions. Our goal is to alert you to tax planning ideas that might prove helpful in these last days of 2024. We have tried to organize this communication in a “checklist” format, separated between issues affecting individuals and businesses, so that you can more quickly identify concerns relevant to your situation. We have also included some comments on other matters of interest that are not directly relate to income taxes, but may be worth considering. We hope the following proves to be helpful to you. Tax planning remains very much a case-by-case analysis. Because we are limited with what we can cover in this format, we also encourage you to visit our website at www.dowellcpa.com, where we regularly post articles that relate to businesses, individuals, trusts, and estates. In a world that continues to go through so many changes, we are here to serve you. If you have a question or concern, please contact us. We also want to take the time to thank you. In this busy world, we know that we do not often slow down enough to say thanks. We know that we would not be here as a thriving firm without you. Most importantly, whatever your faith or beliefs, we wish you peace, good health, and good relationships this holiday season and in the years ahead. Sincerely, Dowell Group, LLP Individuals - Year-End Tax Planning □ Higher-income individuals must be wary of the 3.8% surtax on certain unearned income. The surtax is 3.8% of the lesser of: (1) net investment income (NII), or (2) the excess of MAGI over a threshold amount ($250,000 for joint filers or surviving spouses, $125,000 for a married individual filing a separate return, and $200,000 in any other case). As year-end nears, the approach taken to minimize or eliminate the 3.8% surtax will depend on the taxpayer's estimated MAGI and NII for the year. Some taxpayers should consider ways to minimize (e.g., through deferral) additional NII for the balance of the year, others should try to reduce MAGI other than NII, and some individuals will need to consider ways to minimize both NII and other types of MAGI. An important exception is that NII does not include distributions from IRAs or most other retirement plans. □ The 0.9% additional Medicare tax also may require higher-income earners to take year-end action. It applies to individuals whose employment wages and self-employment income total more than an amount equal to the NIIT thresholds, above. Employers must withhold the additional Medicare tax from wages in excess of $200,000 regardless of filing status or other income. Self-employed persons must take it into account in figuring estimated tax. There could be situations where an employee may need to have more withheld toward the end of the year to cover the tax. This would be the case, for example, if an employee earns less than $200,000 from multiple employers but more than that amount in total. Such an employee would owe the additional Medicare tax, but nothing would have been withheld by any employer. □ Long-term capital gain from sales of assets held for over one year is taxed at 0%, 15% or 20%, depending on the taxpayer's taxable income. If you hold long-term appreciated-in-value assets, consider selling enough of them to generate long-term capital gains that can be sheltered by the 0% rate. The 0% rate generally applies to the excess of long-term capital gain over any short-term capital loss to the extent that, when added to regular taxable income, it is not more than the maximum zero rate amount (e.g., $94,050 for a married couple for 2024). If the 0% rate applies to long-term capital gains you took earlier this year for example, you are a joint filer who made a profit of $5,000 on the sale of stock held for more than one year and your other taxable income for 2024 is $89,050 or less then try not to sell assets yielding a capital loss before year-end, because the first $5,000 of those losses won't yield a benefit this year. (It will offset $5,000 of capital gain that is already tax-free.) □ Postpone income until next year and accelerate deductions into this year if doing so will enable you to claim larger deductions, credits, and other tax breaks for this year that are phased out over varying levels of adjusted gross income (AGI). These include deductible IRA contributions, child tax credits, higher education tax credits, and deductions for student loan interest. Postponing income also is desirable for taxpayers who anticipate being in a lower tax bracket next year due to changed financial circumstances. Note, however, that in some cases, it may pay to actually accelerate income into this year. For example, that may be the case for a person who will have a more favorable filing status this year than next (e.g., head of household versus individual filing status), or who expects to be in a higher tax bracket next year. □ If you believe a Roth IRA is better for you than a traditional IRA, consider converting traditional-IRA money invested in any beaten-down stocks (or mutual funds) into a Roth IRA this year if eligible to do so. Keep in mind that the conversion will increase your income this year, possibly reducing tax breaks subject to phaseout at higher AGI levels. This may be desirable, however, for those potentially subject to higher tax rates under pending legislation. □ It may be advantageous to try to arrange with your employer to defer, until early next year, a bonus that may be coming your way. This might cut as well as defer your tax. Again, considerations may be different for the highest income individuals. □ Many taxpayers won't want to itemize because of the high standard deduction amounts that apply for 2024 ($29,200 for joint filers, $14,600 for singles and for marrieds filing separately, $21,900 for heads of household), and because many itemized deductions have been reduced or abolished. Like last year, no more than $10,000 of state and local taxes may be deducted; miscellaneous itemized deductions (e.g., tax preparation fees and unreimbursed employee expenses) are not deductible; and personal casualty and theft losses are deductible only if they're attributable to a federally declared disaster and only to the extent the $100-per-casualty and 10%-of-AGI limits are met. You can still itemize medical expenses but only to the extent they exceed 7.5% of your adjusted gross income, state and local taxes up to $10,000, your charitable contributions, plus interest deductions on a restricted amount of qualifying residence debt, but payments of those items won't save taxes if they don't cumulatively exceed the standard deduction for your filing status. □ Some taxpayers may be able to work around these deduction restrictions by applying a bunching strategy to pull or push discretionary medical expenses and charitable contributions into the year where they will do some tax good. For example, a taxpayer who will be able to itemize deductions this year but not next year will benefit by making two years' worth of charitable contributions this year, instead of spreading out donations over 2024 and 2025. For 2022-2025, the deduction for charitable contributions of individuals is limited to 60% of the contribution base (generally, AGI). □ If you expect to owe state and local income taxes when you file your return next year and you will be itemizing this year, consider asking your employer to increase withholding of state and local taxes (or pay estimated tax payments of state and local taxes) before year-end to pull the deduction of those taxes into this year. But remember that state and local tax deductions are limited to $10,000 per year, so this strategy is not good to the extent it causes your state and local taxes paid this year to exceed $10,000. □ If you were 73 or older this year you must take a required minimum distribution (RMD) from any IRA or 401(k) plan (or other employer-sponsored retirement plan) of which you are a beneficiary. Those who turn 73 this year have until April 1 of next year to take their first RMD but may want to take it by the end of this year to avoid having to double up on RMDs next year. □ If you are age 70½ or older by the end of this year, have traditional IRAs, and especially if you are unable to itemize your deductions, consider making charitable donations via qualified charitable distributions from your IRAs by the end of the year. These distributions are made directly to charities from your IRAs, and the amount of the contribution is neither included in your gross income nor deductible on Schedule A, Form 1040. However, you are still entitled to claim the entire standard deduction. For 2024, distributions of up to $105,000 per taxpayer are tax-free (increasing as a result of inflation adjustment to $108,000 in 2025). (Previously, those who reached reach age 70½ during a year weren't permitted to make contributions to a traditional IRA for that year or any later year. While that restriction no longer applies, the qualified charitable distribution amount must be reduced by contributions to an IRA that were deducted for any year in which the contributor was age 70½ or older, unless a previous qualified charitable distribution exclusion was reduced by that post-age 70½ contribution.) The IRA qualified charitable distribution also allows distributions to charities (up to $53,000) through charitable gift annuities, charitable remainder unitrusts, and charitable remainder annuity trusts. □ If you are younger than age 70½ at the end of the year, you anticipate that you will not itemize your deductions in later years when you are 70½ or older, and you don't now have any traditional IRAs, establish and contribute as much as you can to one or more traditional IRAs this year. If these circumstances apply to you, except that you already have one or more traditional IRAs, make maximum contributions to one or more traditional IRAs this year. Then, in the year you reach age 70½, make your charitable donations by way of qualified charitable distributions from your IRA. Doing this will allow you, in effect, to convert nondeductible charitable contributions that you make in the year you turn 70½ and later years, into currently deductible IRA contributions and reductions of gross income from later year distributions from the IRAs. □ Take an eligible rollover distribution from a qualified retirement plan before the end of the year if you are facing a penalty for underpayment of estimated tax and having your employer increase your withholding is unavailable or won't sufficiently address the problem. Income tax will be withheld from the distribution and will be applied toward the taxes you owe this year. You can then timely roll over the gross amount of the distribution, i.e., the net amount you received plus the amount of withheld tax, to a traditional IRA. No part of the distribution will be includible in this year's income, but the withheld tax will be applied pro rata over the full tax year to reduce previous underpayments of estimated tax. □ Consider increasing the amount you set aside for next year in your employer's FSA if you set aside too little for this year and anticipate similar medical costs next year. □ If you become eligible by December to make health savings account (HSA) contributions, you can make a full year's worth of deductible HSA contributions for the current year. □ Make gifts sheltered by the annual gift tax exclusion before the end of the year if doing so may save gift and estate taxes. The exclusion applies to gifts of up to $18,000 made in 2024 to each of an unlimited number of individuals. You can't carry over unused exclusions from one year to the next. Such transfers may save family income taxes where income-earning property is given to family members in lower income tax brackets who are not subject to the kiddie tax. □ If you were in a federally declared disaster area, and you suffered uninsured or unreimbursed disaster-related losses, keep in mind you can choose to claim them either on the return for the year the loss occurred, or on the return for the prior year, generating a quicker refund. □ If you were in a federally declared disaster area, you may want to settle an insurance or damage claim in the current year to maximize your casualty loss deduction this year. Individuals – Other Considerations at Year-End □ Review your portfolio – The end of the year is a perfect time to analyze your holdings and determine if the risk tolerances and asset allocations are still appropriate for your investment objectives. Consider your age, health, and family issues. □ Review beneficiary designations – Review the beneficiaries named on retirement accounts or insurance policies; consider if assets are titled correctly; determine if a family member should be added as a signer on an account. □ Wills and Trusts - If you have not set up wills and trusts, then contact your attorney; call us if you need a reference. If it has been many years since you had your wills and trusts drafted, set up a meeting with your attorney or CPA to review the documents, including the named beneficiaries, guardians, and executors. □ Estate planning – The amount of an individual’s estate that is exempt from estate taxes in 2024 is $13.61 million (double that amount for a married couple). States, like Illinois, may have lower thresholds for the amounts that are subject to state inheritance taxes. Planning is required to make sure that your estate is optimally situated for estate tax purposes. □ Grantor (“Living”) trusts – If you have substantial assets, you should consider creating a grantor (also known as living or revocable) trust. If you have a grantor trust, be sure that all assets are held in that trust; brokerage accounts should be titled in the name of the trust. □ Power of Attorney - As part of the review of wills and trusts, also consider powers-of-attorney and health care powers-of-attorney you have in force (or should have in force) for all of your family members. □ Insurance - Review the various types of insurance coverages you have in place and re-examine your needs. This includes homeowner’s, auto, life, health, disability, umbrella liability, and long-term care. □ Family meeting – While there may be a few more family gatherings this year compare to last year, many will still be “zooming” their loved ones at the holidays. Whether your family is zooming or in-person, consider having a family meeting to give an overview of your investments and objectives, charitable giving strategies and desires, the location of key documents, and names of your key advisors (CPAs, attorneys, bankers, insurance agents, investment advisors, etc.). □ Safe deposit box - Make a special point to visit your safe deposit box and inventory (and organize) the contents. Make sure your executor, spouse, or other key person knows where the key is kept. □ Cyber Security – Many of us have been subject to some level of privacy violations. Consider if you should purchase personal identify theft protection. One good practice is to check once a year with the three major credit bureaus, where you can pull a credit report for free. □ Passwords – The passwords to your critical accounts (bank, investments, insurance) should be someplace where they are accessible in the event of your illness or death. Your password list should include other accounts as well that are password protected (like phones, internet, email, etc.). Businesses - Year-End Tax Planning □ Taxpayers other than corporations may be entitled to a deduction of up to 20% of their qualified business income. For 2024, if taxable income exceeds $383,900 for a married couple filing jointly, (about half that for others), the deduction may be limited based on whether the taxpayer is engaged in a service-type trade or business (such as law, accounting, health, or consulting), the amount of W-2 wages paid by the business, and/or the unadjusted basis of qualified property (such as machinery and equipment) held by the business. The limitations are phased in; for example, the phase-in applies to joint filers with taxable income up to $100,000 above the threshold, and to other filers with taxable income up to $50,000 above their threshold. (For 2025, the amount rises to $394,600.) □ Taxpayers may be able to salvage some or all of this deduction, by deferring income or accelerating deductions to keep income under the dollar thresholds (or be subject to a smaller deduction phaseout) for the current year. Depending on their business model, taxpayers also may be able increase the deduction by increasing W-2 wages before year-end. The rules are quite complex, so don't make a move in this area without consulting us. □ More small businesses are able to use the cash (as opposed to accrual) method of accounting than were allowed to do so in earlier years. To qualify as a small business a taxpayer must, among other things, satisfy a gross receipts test, which is satisfied for 2024 if, during a three-year testing period which precedes the current year, average annual gross receipts don't exceed $30 million. Cash method taxpayers may find it a lot easier to shift income, for example by holding off billings till next year or by accelerating expenses, for example, paying bills early or by making certain prepayments. (For 2025, the amount rises to $31 million.) □ Businesses should consider making expenditures that qualify for the liberalized business property expensing option. For tax years beginning in 2024, the expensing limit is $1,220,000, and the investment ceiling limit is $3,050,000. For 2025, the amounts rise to $1,250,000 and $3,130,000, respectively. Expensing is generally available for most depreciable property (other than buildings) and off-the-shelf computer software. It is also available for interior improvements to a building (but not for its enlargement), elevators or escalators, or the internal structural framework), for roofs, and for HVAC, fire protection, alarm, and security systems. □ The generous dollar ceilings mean that many small and medium sized businesses that make timely purchases will be able to currently deduct most if not all their outlays for machinery and equipment. What's more, the expensing deduction is not prorated for the time that the asset is in service during the year. So expensing eligible items acquired and placed in service in the last days of the current year, rather than at the beginning of next year, can result in a full expensing deduction on this year's return. □ Businesses also can claim a 60% bonus first year depreciation deduction for machinery and equipment bought used (with some exceptions) or new if purchased and placed in service in 2024, and for qualified improvement property, described above as related to the expensing deduction. The 60% write-off is permitted without any proration based on the length of time that an asset is in service during the tax year. Now is the time to take advantage of bonus depreciation as it is being phased out. It will be 40% in 2025, and 20% in 2026. Bonus depreciation will not be available after 2026. □ Businesses may be able to take advantage of the de minimis safe harbor election (also known as the book tax conformity election) to expense the costs of lower-cost assets and materials and supplies, assuming the costs aren't required to be capitalized under the UNICAP rules. To qualify for the election, the cost of a unit of property can't exceed $5,000 if the taxpayer has an applicable financial statement (AFS, e.g., a certified audited financial statement along with an independent CPA's report). If there's no AFS, the cost of a unit of property can't exceed $2,500. Where the UNICAP rules aren't an issue, consider purchasing qualifying items before the end of the year. □ A corporation (other than a large corporation) that anticipates a small net operating loss (NOL) for the current year (and substantial net income next year) may find it worthwhile to accelerate just enough of next year's income (or to defer just enough of its current-year deductions) to create a small amount of net income in the current year. This allows the corporation to base next year's estimated tax installments on the relatively small amount of income shown on its current-year return, rather than having to pay estimated taxes based on 100% of its much larger taxable income for next year. □ Year-end bonuses can be timed for maximum tax effect by both cash - and accrual-basis employers. Cash basis employers deduct bonuses in the year paid, so they can time the payment for maximum tax effect. Accrual-basis employers deduct bonuses in the accrual year, when all events related to them are established with reasonable certainty. However, the bonus must be paid within two months after the end of the employer's tax year for the deduction to be allowed in the earlier accrual year. Accrual employers looking to defer deductions to a higher-taxed future year should consider changing their bonus plans before year end to set the payment date later than the 2.5-month window or change the bonus plan s terms to make the bonus amount not determinable at year end. □ To reduce current-year taxable income, consider deferring a debt-cancellation event until next year. □ Sometimes the disposition of a passive activity can be timed to make best use of its freed-up suspended losses. Where reduction of current-year income is desired, consider disposing of a passive activity before year-end to take the suspended losses against current income. Businesses – Other Considerations □ Corporate records – Update annual resolutions and officer elections. □ Good standing – Verify that the annual franchise tax return has been filed with the State of incorporation or organization. □ Insurance – Consult with your advisors, executive team, and insurance agent to determine if your business, property, and key officers, are adequately insured. □ Buy-sell agreement – If your business has multiple shareholders, consider adopting an agreement to orderly transfer those shares in the event of a sale, retirement, or death. □ Budget – Every business should have a budget or a forecast in place. Assemble your trusted team, pull the data together, study the most recent results, consider objectives for the coming year, and create the budget or forecast. □ Benefits – Many businesses would benefit by checking their benefit package annually, to be sure that it is competitive with the marketplace. This includes retirement accounts offered, insurance options, as well as “soft” benefits like remote work and flex-time. □ Compensation – Consider if the level of pay of your current employees is competitive. In today’s competitive environment, it is often much easier to retain a key employee than recruit one. □ Cyber Security – It seems that a day rarely goes by without a story about a business being hacked. Cyber security should rank at the top of everyone’s list. Discuss weaknesses in your server, systems, or procedures with internal staff and with experts in the field. There are some good 3rd parties that can be engaged to test your systems and people. □ Other Security – Consider other ways your business could be exposed to risk. For instance, is your building secured with proper alarms, cameras, etc. □ Entity type – Even though making a change is not likely, sit down with your attorney and CPA to discuss entity type; maybe your business would benefit by considering a different structure. Limited liability companies have grown in popularity, but there is also a place for S corporations, and C corporations may still offer some advantages. □ Ownership structure – There may be a number of reasons to consider the ownership of a business, including the need to reward and retain key employees, to gain income tax or estate tax advantages. □ Acquisitions – Expanding in the marketplace may offer strategic advantages to a business, whether to open up new markets, access new customers, or gain skill sets. Identifying key targets may be something to consider in the new year, if it fits with the goals of ownership.