IRS Issues Revenue Procedure 2015-20 to Make It Easier for Small Businesses to Adopt the Tangible Property Regulations

by Gregory S. Dowell

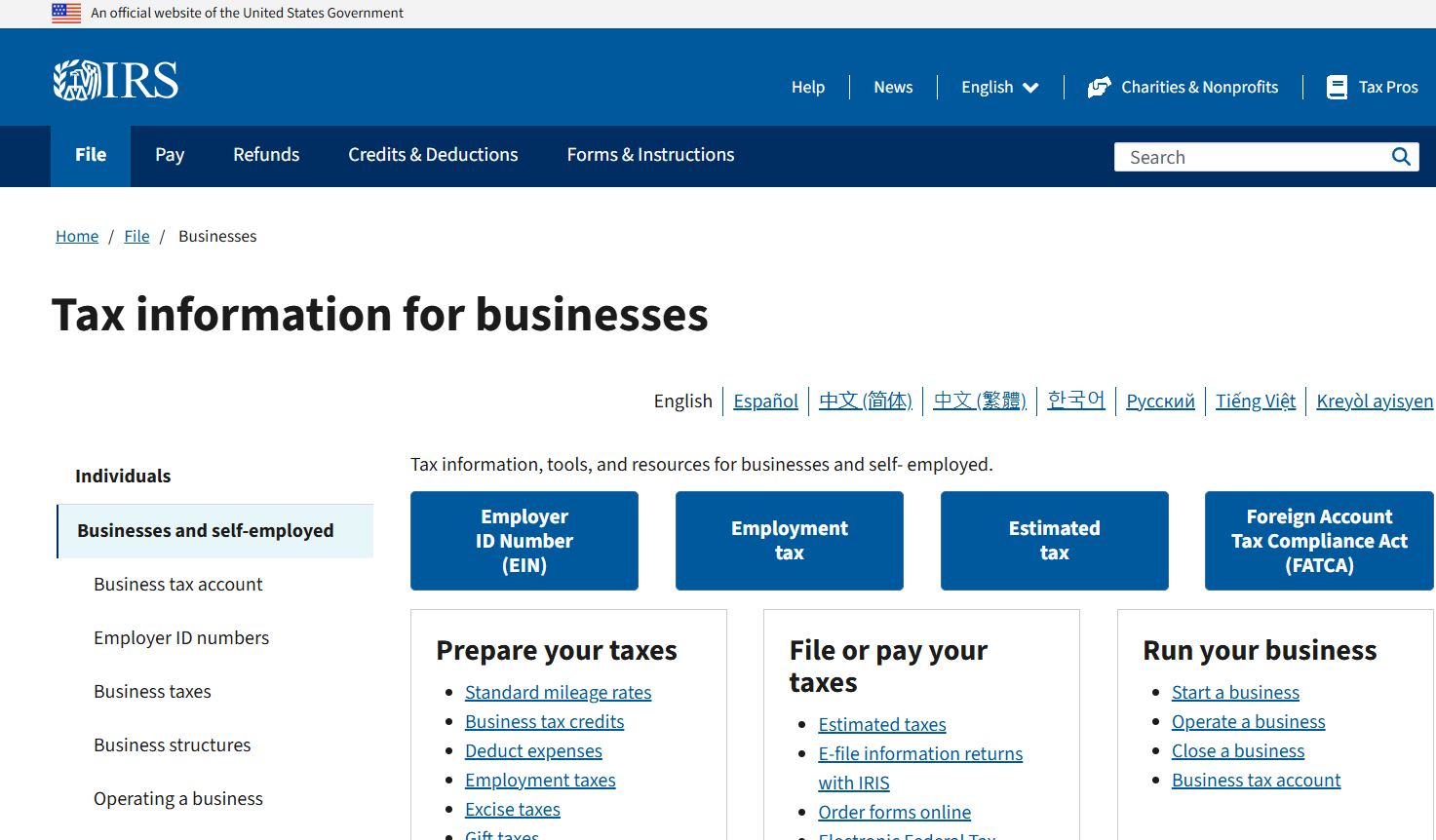

February 17, 2015 – The newly-released IRS Revenue Procedure 2015-20 removes some of the guesswork and makes it easier for small businesses to adopt the new tangible property regulations. Small businesses for this purpose are businesses with under $10 million of assets or $10 million or less of gross receipts. In general, in most cases these procedures prevent the small business from having to adopt a formal change in accounting policy when applying the new tangible property regulations. The new revenue procedure also clarifies de minimis safe harbor provision of the regulations. This new procedure is effective for tax years beginning on or after January 1, 2014.

As way of background, in 2013 and during 2014, the IRS issued regulations related to capitalizing, deducting, and disposing of costs of tangible personal property. Existing IRS Code and regulations (IRC section 446 and regulation 1.446-1) require a taxpayer to secure the consent of IRS before changing an accounting method for federal tax purposes. Furthermore, regulation 1.263(a) allows for a de minimis safe harbor to allow certain expenditures to be deducted as ordinary and necessary, rather than capitalized. The regulation also provided that a taxpayer without an applicable financial statement may elect to apply the de minimis safe harbor if, among other things, the amount paid for the property subject to the de minimis safe harbor does not exceed $500 per invoice.

Revenue Procedures 2015-20 effectively allows small business taxpayers to make changes in methods of accounting with an IRC section 481 adjustment that takes into account only amounts paid or incurred, and dispositions, in tax years beginning on or after January 1, 2014. This modification means that, effectively, small business taxpayers making these changes in accounting method for the first tax year that begins on or after January 1, 2014, may elect to make the change on a cut-off basis.

The option for some small businesses to choose to file a Form 3115 remains available. This may be desired to retain a clear record of a change in method of accounting or to make permissible concurrent automatic changes on the same form. However, other small business taxpayers may prefer the administrative convenience of being able to comply with the final tangible property regulations in their first tax year that begins on or after January 1, 2014, simply by filing the federal tax return. In those cases, for the first tax year that begins on or after January 1, 2014, small business taxpayers that choose to prospectively apply the tangible property regulations to amounts paid or incurred, and dispositions, in tax years beginning on or after January 1, 2014, have the option of making certain tangible property changes in method of accounting on the federal tax return without including a separate Form 3115 or separate statement.

A small business taxpayer is a taxpayer with one or more separate and distinct trade or business that has: (a) total assets of less than $10 million as of the first day of the tax year for which a change in method of accounting under the final tangible property regulations and corresponding procedures regarding related changes in method of accounting is effective; or (b) average annual gross receipts of $10 million or less for the prior three tax years.

The IRS also clarifies that the de minimis safe harbor does not limit a taxpayer’s ability to deduct otherwise deductible repair or maintenance costs that exceed the amount subject to the safe harbor. The safe harbor merely establishes a minimum threshold below which all qualifying amounts are considered deductible. Consistent with longstanding law, a taxpayer may continue to deduct all otherwise deductible repair or maintenance costs, regardless of amount. In addition, the existence of the de minimis safe harbor does not mean that a taxpayer cannot establish a de minimis deduction threshold in excess of the safe harbor amount, provided the taxpayer can demonstrate that a higher threshold clearly reflects the taxpayer’s income.