Republican Senators Declare That Technical Corrections to the Tax Act Are Needed

by Gregory S. Dowell

August 17, 2018

As tax practitioners, CPAs and attorneys have been frustrated because of the number of provisions of the Tax Cuts and Jobs Act (the tax act that was pushed through Congress late in 2017) are so poorly written, making it nearly impossible to advise our clients in many cases. We’re glad to know it’s not just us.

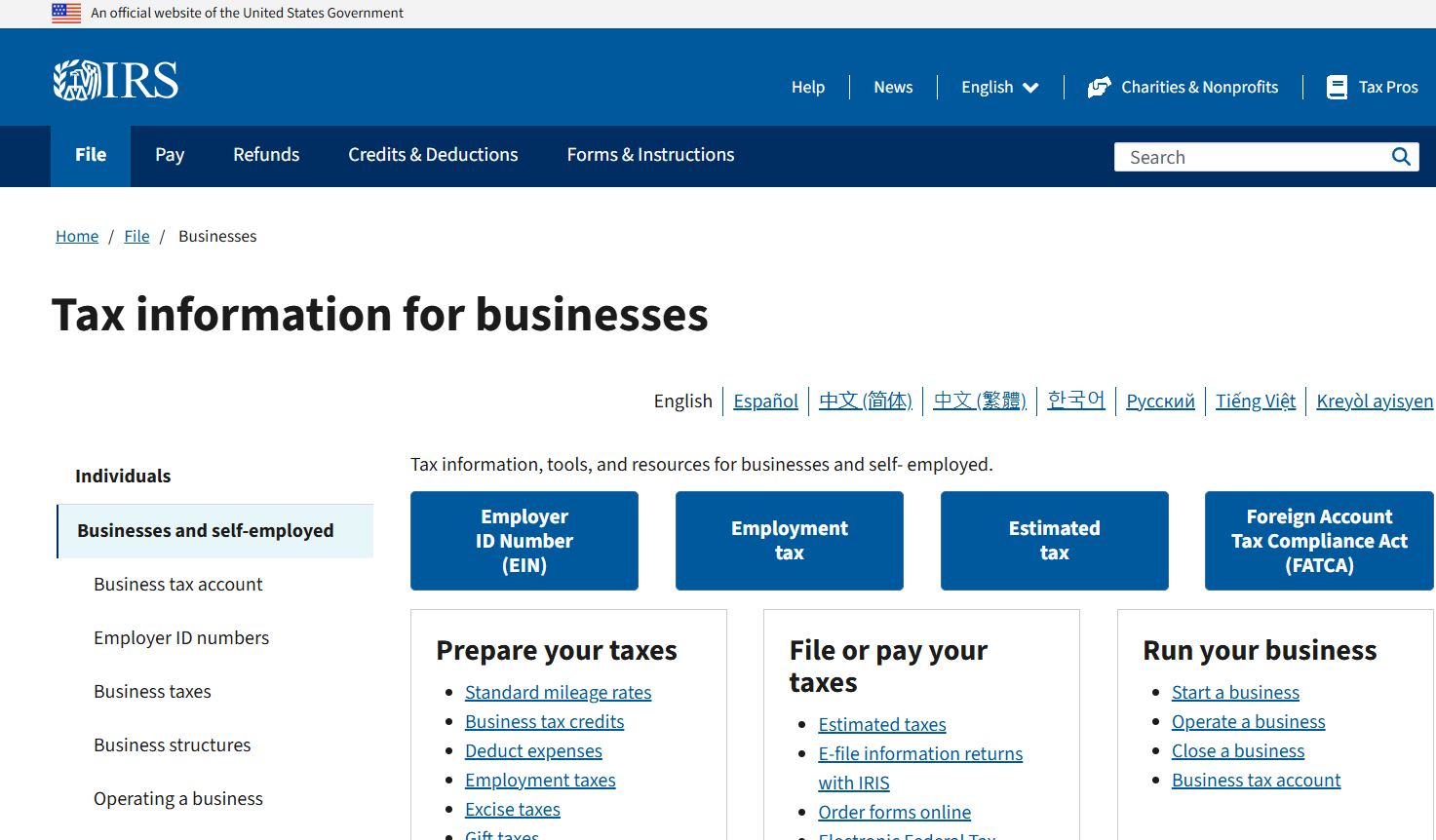

In a very unusual move, Republicans on the Senate Finance Committee have asked the IRS and the Treasury Department (the oversight arm for the IRS) to issue guidance and clarify certain provisions of the TCJA, based on the Senators’ explanation of the intent of the lawmakers when the act was written. The three areas of interest relate to expensing qualified improvement property, the net operating loss deduction, and deducting expenses in sexual misconduct settlements. Because the intent is being expressed only by these Republican Senators, it remains to be seen if other Democratic legislators, or Republicans, decide that they must weigh in as well, which would seem to create a nightmare scenario for the IRS. Taxpayers should expect some pushback politically, and also expect that other areas in the TCJA needing clarity will gain attention in the months ahead.

The Senators noted the following:

- Expensing Qualified Improvement Property – The intent was that qualified improvement property should be 15-year property subject to MACRS and a 20-year ADS recovery period.

- Net Operating Losses – Legislative intent was to provide that the NOL carryforward and carryback modifications are effective for NOLs arising in taxable years beginning after 12-31-17.

- Sexual harassment – The TCJA states that a deduction is denied for any settlement or payment related to sexual harassment or sexual abuse if a settlement or payment is subject to a nondisclosure agreement, and denies a deduction for attorney’s fees related to the settlement or payment. As written, the Senators note that the recipient of a payment may be prohibited from deducting their legal fees; the intent was that these attorney fees would not be subject to this provision.

From our perspective, this is the tip of the iceberg, and more clarification is needed, and soon. The IRS just recently released some guidance on how to interpret the new 20% deduction for pass-through income and, while helpful, many questions remain unanswered about the application of the 20% deduction.