Underpayment Penalty Relief for Individuals

January 24, 2019

by Gregory S. Dowell

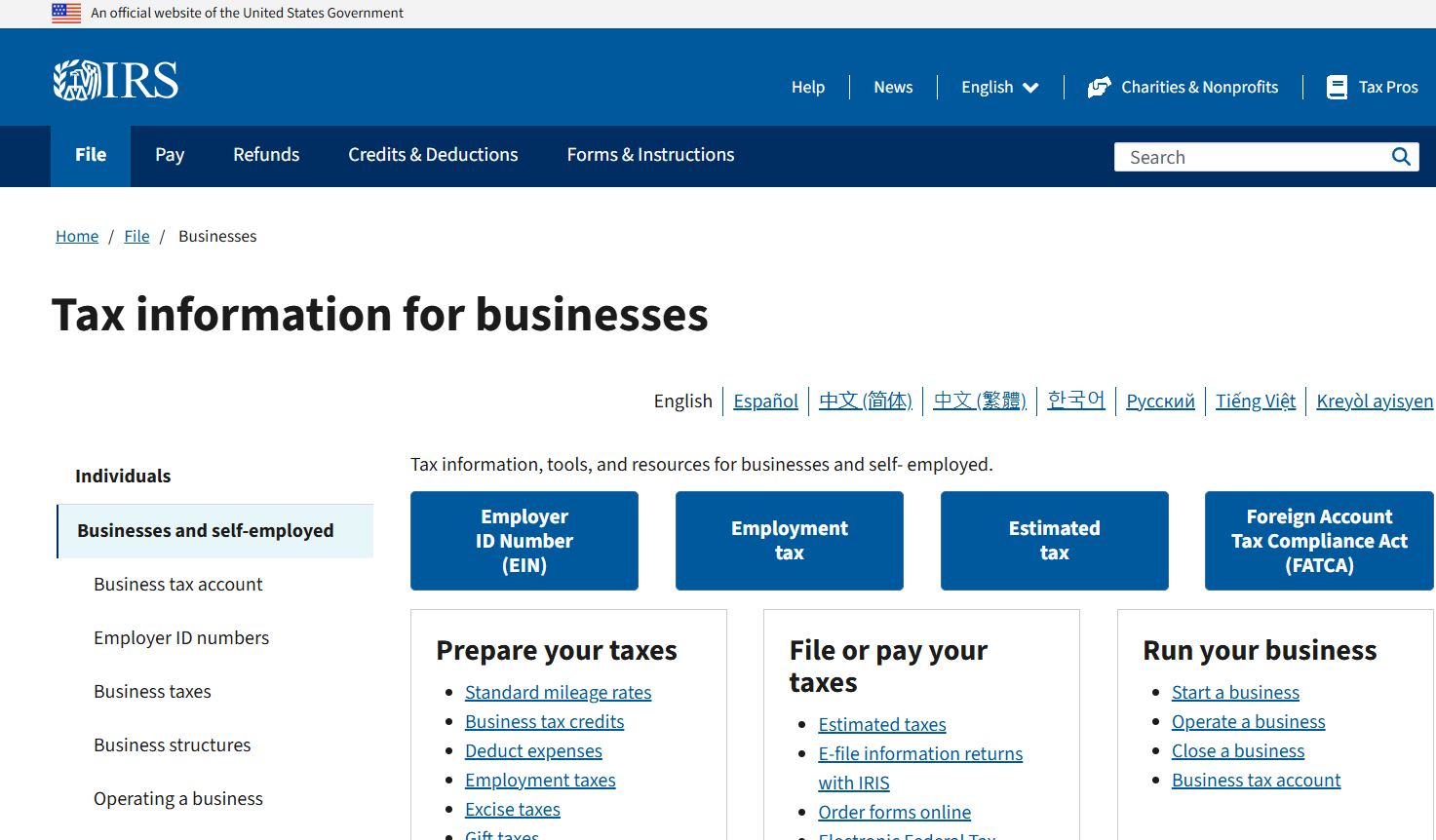

In what came as a surprise move to many, the IRS issued Notice 2019-11, which provides that individuals will be granted relief from the penalty for underpaying estimated income taxes if they have paid in at least 85% of their 2018 income tax liability via withholding and/or estimated tax payments. This relief was granted by the IRS as a nod to the difficulties and confusion taxpayers are encountering as they try to interpret the effects of the Tax Cut and Jobs Act (TCJA) on their individual situations. Many key provisions of the act – for instance, the qualified business income deduction – were lacking IRS interpretation until well into 2018, leaving a considerable amount of uncertainty for taxpayers. Business owners (those with S corps, partnerships, LLCs, and sole proprietors) as well as investors, in particular, will benefit from this news, as much of the uncertainties in the TCJA disproportionately fell on topics that were of concern to them.

While much of the delay on the part of the IRS was due to poorly drafted language in the TCJA, the Notice also indicates that the IRS is stepping up to take some of the blame for the confusion, in that the withholding calculator that it made available early in 2018, along with the withholding form W-4, were not as clear and instructive as they could have been.

For a little background on the underpayment topic, an individual taxpayer can be penalized if he or she fails to pay enough taxes during the course of the year, either through withholding (typically from wages, but also from retirement distributions or withholdings on dividends and interest) or by making timely quarterly estimated income tax payments. Section 6654 of the Internal Revenue Code indicates that the minimum amount that must be paid to avoid penalty is 90% of the tax shown on the income tax return for the year, or 100% of the tax shown on the taxpayer’s prior year income tax return (the 100% increases to 110% if the adjusted gross income on the return exceeds certain thresholds). This recently announced change in Notice 2019-11, which is only in effect for 2018, reduces the 90% benchmark above to 85%. To show that the taxpayer made the minimum payments during the course of the year, form 2210 is completed and attached to the taxpayer’s return.

While this was clearly the “right” thing to do, it is reassuring to see that the IRS has the ability to interpret laws equitably, and not just in a punitive fashion against taxpayers.